With the start of 2026, many bank account holders are searching for clear information about the ATM cash withdrawal tax rate, daily limits, and how these rules affect filers and non-filers. The Federal Board of Revenue (FBR) continues to use cash withdrawal taxation as a tool to promote documented transactions and improve tax compliance across Pakistan.

What Is ATM Cash Withdrawal Tax?

ATM cash withdrawal tax is a withholding tax deducted by banks when an account holder withdraws cash beyond a specific daily threshold. This tax is collected automatically and transferred to the government as part of income tax regulations.

It is important to note that:

- This is not a bank service fee

- It is deducted only when the daily limit is crossed

- It applies mainly to large cash withdrawals

- The tax rate differs for tax filers and non-filers

The objective behind this policy is to discourage excessive cash usage and encourage individuals to become part of the formal tax system.

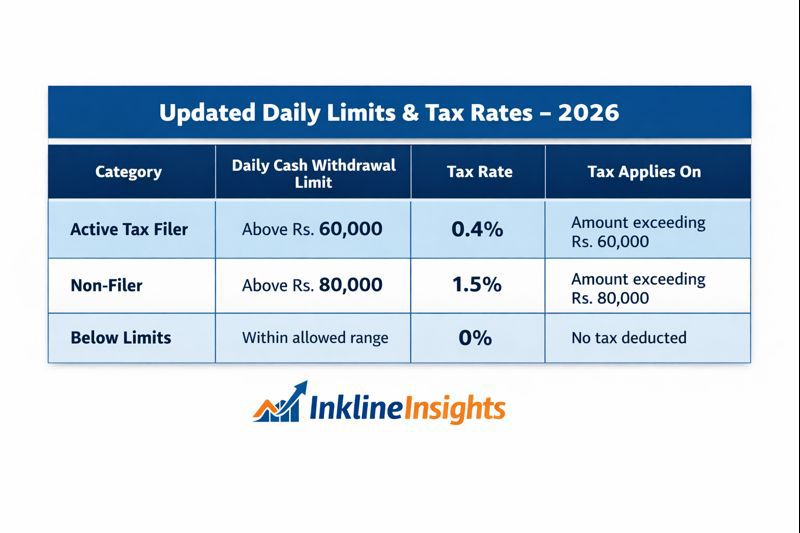

ATM Cash Withdrawal Tax Rates 2026 (Latest Update)

As per the latest taxation framework continuing into 2026, different rules apply based on tax filer status.

Updated Daily Limits & Tax Rates

✔ The tax is not applied on the full amount, only on the portion that exceeds the daily limit.

How ATM Cash Withdrawal Tax Is Calculated

Understanding calculations with examples makes the rules easier to follow.

Example 1: Tax Filer

- Daily withdrawal: Rs. 70,000

- Tax-free limit: Rs. 50,000

- Taxable amount: Rs. 20,000

- Tax @ 0.3%: Rs. 60

Total tax deducted: Rs. 60

Example 2: Non-Filer

- Daily withdrawal: Rs. 100,000

- Tax-free limit: Rs. 75,000

- Taxable amount: Rs. 25,000

- Tax @ 1.2%: Rs. 300

Total tax deducted: Rs. 300

These examples clearly show how being a filer significantly reduces tax impact.

Why the Government Imposes This Tax

The ATM withdrawal tax is part of broader economic reforms aimed at:

- Reducing undocumented cash transactions

- Encouraging digital payments and banking channels

- Expanding the national tax base

- Rewarding compliant taxpayers

- Increasing transparency in financial activity

Cash-heavy economies face challenges in tracking income, which is why governments worldwide encourage digital transactions.

Who Is Required to Pay This Tax?

Tax Filers

- Individuals listed on the Active Taxpayer List (ATL)

- Subject to a lower tax rate

- Still taxed if daily withdrawal exceeds Rs. 50,000

Non-Filers

- Individuals not listed on ATL

- Subject to a higher tax rate

- Allowed a slightly higher withdrawal limit, but taxed heavily afterward

Exemptions

Certain entities may be exempt, including:

- Government departments

- Diplomatic missions

- Accounts holding valid tax exemption certificates

Exemptions depend on official documentation and bank verification.

Is This Tax Adjustable or Refundable?

Yes. ATM cash withdrawal tax is adjustable at the time of filing an income tax return.

- Tax filers can adjust it against final tax liability

- If excess tax is deducted, it may be refundable

- Non-filers cannot claim adjustment unless they file returns

This makes tax filing beneficial even for individuals with modest income.

Additional Charges to Be Aware Of

Besides tax, banks may also charge:

- ATM service fees

- Non-host ATM transaction charges

- Daily withdrawal limit penalties (bank-specific)

These charges are separate from government tax and vary from bank to bank. Always check your bank’s official schedule of charges.

How to Reduce or Avoid ATM Withdrawal Tax

1. Become an Active Tax Filer

This is the most effective solution. Benefits include:

- Lower tax rate

- Easier refunds and adjustments

- Fewer financial restrictions

2. Plan Withdrawals Smartly

- Withdraw amounts within daily limits

- Avoid unnecessary large cash withdrawals

3. Use Digital Alternatives

- Bank transfers

- Mobile banking

- Debit card payments

- Online transactions

Digital methods often involve lower or zero tax exposure.

Impact on Businesses & Freelancers

Small businesses and freelancers who rely heavily on cash should be especially careful. Frequent large withdrawals may result in:

- Repeated tax deductions

- Cash flow pressure

- Record-keeping challenges

Maintaining proper accounts and switching to digital payment channels can significantly improve financial efficiency.

Future Outlook for Cash Withdrawal Taxes

Policy trends indicate that:

- Tax rates for non-filers may increase further

- Digital transaction incentives may expand

- Cash-based restrictions may tighten

- Filing income tax returns will become more important than ever

Staying informed helps individuals avoid penalties and plan finances effectively.

Final Words

The ATM cash withdrawal tax in 2026 is not meant to penalize ordinary banking users but to promote transparency and tax compliance. Understanding the latest rates, limits, and rules allows individuals to make informed decisions and avoid unnecessary deductions.

Whether you are salaried, self-employed, or a business owner, smart financial planning and tax compliance can save money and ensure peace of mind.

Leave a Reply